Investment Options in Recession: Real Estate, Bonds & Gold

As we navigate through the current period of global economic decline, investors are actively seeking stable and growth-oriented investment options, making the choice among real estate, bonds, and gold particularly crucial. Real estate investments are often preferred for their potential to provide a stable income through rentals and long-term capital appreciation.

As the economy faces a recession, investors are increasingly seeking investment options that offer stability and growth potential. Navigating the investment landscape in uncertain times can be challenging, and the choice between asset classes such as real estate, bonds, and gold becomes crucial.

Real Estate

Real estate investments include residential, commercial, and industrial properties. These investments can offer a stable source of income through rental returns, as well as the potential for long-term capital appreciation.

During the recession, the real estate market can face challenges as property values and rental incomes may decline due to decreased demand and economic uncertainty.

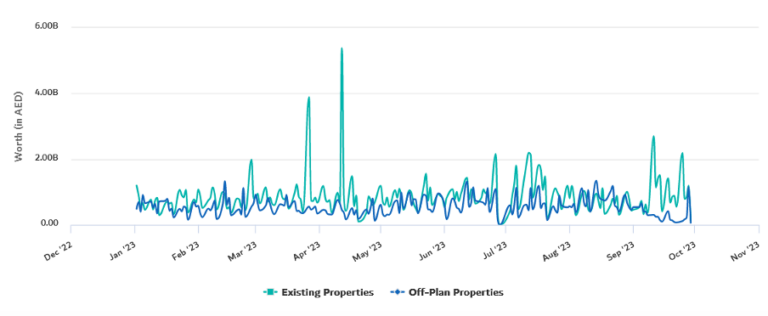

The situation is different in Dubai. K Estates’ 9-month report shows a significant increase in transactions, with 92,411 sales transactions worth AED 276.80B.

Calculating ROI for Real Estate

To calculate the ROI for a real estate investment, you’ll need to consider both the income generated from the property and the appreciation in its value.

The basic formula for calculating ROI is:

ROI = (Current Value of Investment - Initial Investment) / Initial Investment

For real estate, the current value of the investment would include the property’s current market value and any rental income generated.

To calculate the annual ROI, you can use the following formula:

Annual ROI = (Annual Rental Income + (Current Market Value - Purchase Price)) / Purchase Price

Keep in mind that expenses, such as service charges and insurance, should be factored into the calculation. The ROI for real estate can vary widely based on factors like property type, location, view, and market conditions.

Bonds

Bonds, particularly government and high-quality corporate bonds, are generally considered safe investments during a recession. They provide regular income through interest payments and can act as a hedge against stock market declines. However, interest rates may be low during a recession, which can result in lower returns, as the interest payments become less attractive compared to alternative investments.

For bonds, the ROI can be determined by calculating the total return, which includes both interest income and capital gains (or losses) from changes in bond prices.

The basic formula for bond ROI is:

ROI = (Interest Income + (Current Bond Price - Purchase Price)) / Purchase Price

To calculate the annual ROI, you can divide the total ROI by the number of years you held the bond. Keep in mind that bond prices can be affected by interest rate fluctuations and the credit quality of the issuer.

Gold

Gold is often considered a safe-haven investment during economic downturns because it tends to maintain its value better than other assets. Investors often turn to gold as a store of value and a hedge against inflation.

While gold offers some level of protection against market volatility, it’s important to note that it does not generate regular income like bonds or real estate, relying solely on price appreciation for returns.

Additionally, the price of gold can be subject to fluctuations due to factors such as geopolitical events, changes in market sentiment, and shifts in global economic conditions.

Gold is a commodity, and its ROI is primarily based on the change in its price over time. To calculate the ROI for gold, you can use the following formula:

ROI = (Current Gold Price - Purchase Price) / Purchase Price X 100

Using the previous example, if you bought gold at $1,000 per ounce and it’s now worth $1,200 per ounce, the ROI would be 20%. The ROI for gold can be volatile, as it’s influenced by factors such as economic conditions, inflation, and geopolitical events.

Conclusion

In conclusion, each investment option—real estate, bonds, and gold—offers unique advantages and challenges, especially during a recession. Your decision should align with your financial goals, risk tolerance, and investment horizon.

Real estate in Dubai, as highlighted by the strong performance in K Estates’ report, shows resilience and growth potential, making it an appealing choice. The combination of rental income and potential property value appreciation, particularly in a robust market like Dubai, can offer attractive returns. While real estate does come with its own set of risks, such as market fluctuations and property management challenges, the current upward trend in Dubai’s real estate market suggests a favorable environment for investment.