Dubai Real Estate Trends: The Cost of Real Estate by Districts

Dubai’s real estate scene is a complex blend shaped by dynamic market forces, investor preferences, and urban development. As we navigate through the bustling metropolis, it becomes evident that the cost of real estate is not a one-size-fits-all metric; instead, it is a nuanced reflection of various factors that shape the city’s ever-expanding skyline.

Investment Policies and Emerging Trends

Dubai’s real estate pricing is significantly influenced by the UAE’s investment policies, which allow foreign nationals to acquire freehold properties in designated zones. As a result, areas with established freehold zones boast higher property prices. However, the tides are shifting towards emerging freehold areas, with Mohammed Bin Rashid City (MBR City) taking the lead in transaction volume. The demand for properties under construction is on the rise, indicating a strategic shift among investors.

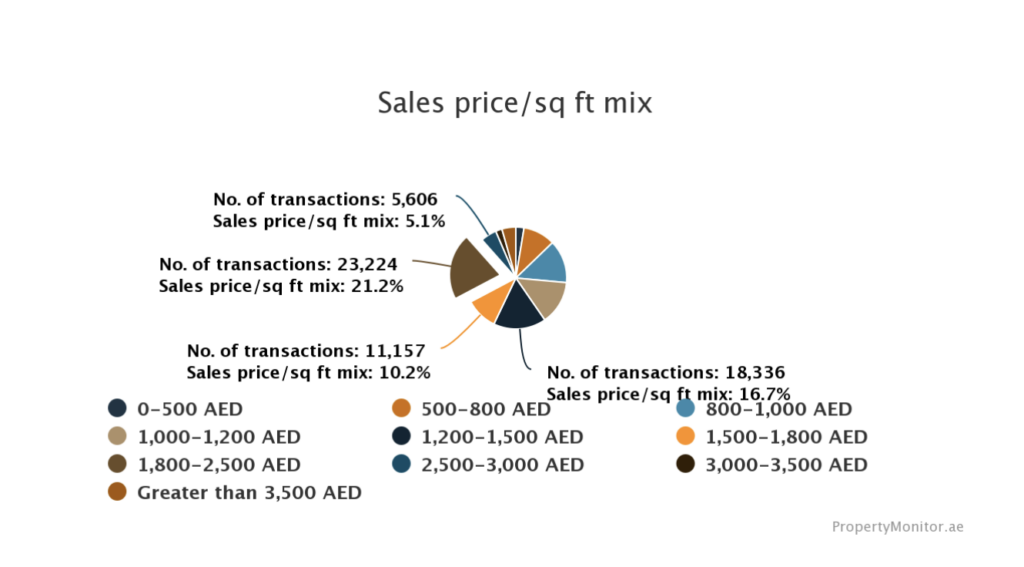

Crucial Metrics: Cost per Square Meter

While the number of bedrooms and amenities remain key considerations for buyers, the cost per square metre emerges as a pivotal metric. K Estates experts highlight the importance of this metric in making informed decisions, emphasising that it varies across districts, offering insights into the optimal real estate options.

Choosing Wisely: Developers, Liquidity, and Demand

Renowned developers such as Dubai Properties, Meraas Development, and Emaar Properties are the first choice of foreign investors. Confidence in both building and grounds is established, and realtors play a crucial role in aligning projects with investment goals. The average starting price for sought-after communities is AED 550,900 (USD 150,000), varying between developers. Dubai Marina, with its 200+ high-rises, exemplifies the diversity in offerings, with Emaar Properties’ high-yield apartments standing out.

Average Price per Square Metre Soars

Recent data from the Dubai Land Department indicates a noteworthy 34.4% surge in the average price per square metre since January 2022, reaching AED 1,575 (USD 428.8). This surge is particularly pronounced in premium housing categories, reflecting a 35% increase for apartments and a substantial 37.2% surge for villas within the average price segment.

District-wise Breakdown: Luxury vs. Affordability

Delving into the district-wise breakdown reveals a stark contrast in property prices. Emirates Living commands the highest at AED 32,000 per square meter, closely followed by Palm Jumeirah, Downtown Dubai, Jumeirah Beach Residence, and Dubai Marina. These districts symbolise luxury living with central locations and opulent amenities.

On the flip side, budget-conscious buyers can explore more affordable options in districts such as International City, Dubai Silicon Oasis, Dubai Sports City, Discovery Gardens, and Jebel Ali. Despite being more budget-friendly, these districts offer a range of amenities and unique lifestyles.

Factors Influencing Costs

Several factors contribute to the variation in real estate costs, with location, property type, size, and amenities taking centre stage. Central areas naturally command higher prices, while apartments prove to be more affordable than villas. Additional amenities, such as swimming pools and gyms, contribute to the overall cost. Market conditions, reflecting the ebb and flow of demand, also play a significant role in shaping property prices.

Conclusion: Dubai – A Dynamic Investment Opportunity

Dubai’s dynamic landscape and exciting prospects make it a beacon for investors and residents alike. The city’s real estate market is poised for continued growth, offering a diverse range of options from luxury to budget-friendly alternatives. As Dubai evolves, so do the opportunities within its districts, solidifying its status as a premier destination for property investment. Whether one seeks opulence or practicality, Dubai’s real estate market provides a plethora of choices, making it an investment opportunity in the making.